NBU raised the key interest rate: how to protect savings from inflation

Journalist

Anna Tkach

27.11.2025 - 16:05

240 viewed

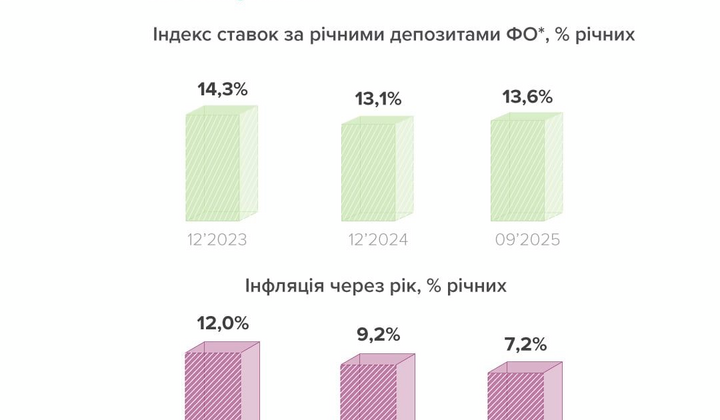

At the beginning of 2025, the NBU decided to raise the key interest rate to 15.5% to protect hryvnia savings from inflation. This allowed banks to offer attractive conditions for hryvnia deposits - on average 13-16% per annum (after taxation - 10-12%) depending on the placement period. A no less popular alternative chosen by citizens has been hryvnia government bonds. They brought returns of 12-18% per annum, and the income earned is not taxed.

Considering the inflation forecasts for 2026 (below 10%), such investment instruments help protect savings from loss due to inflation. In this regard, interest in hryvnia deposits and government bonds is constantly growing.

If you want to learn more, we invite you to visit the updated section 'Simply About the Economy' on the NBU website.

Read also

Inflation in Ukraine continues to slow down: key figures for October-November

yesterday, 13:05

129 viewed

NBU explained why inflation targeting is a support for Ukraine

yesterday, 11:07

120 viewed

The National Bank of Ukraine prepares personnel for the country's economy: how students are assisted by lectures from the First Deputy Governor

yesterday, 10:06

94 viewed

NBU raised the rate to 15.5%: how deposit and government bond yields have changed

03.12.2025 - 00:35

254 viewed

Inflation in Ukraine accelerated to 0.9%: what grew most expensive in October

01.12.2025 - 17:41

169 viewed