Monobank launches shared cards: how to control family expenses

Monobank has expanded its functionality with a new feature – shared cards that allow sharing access to the account with spending limits. This update is useful for families, couples, and parents who want to manage the finances of their children or loved ones.

Co-founder of the bank Oleg Gorokhovskiy announced the launch of this feature. From now on, all clients can use it after updating the application.

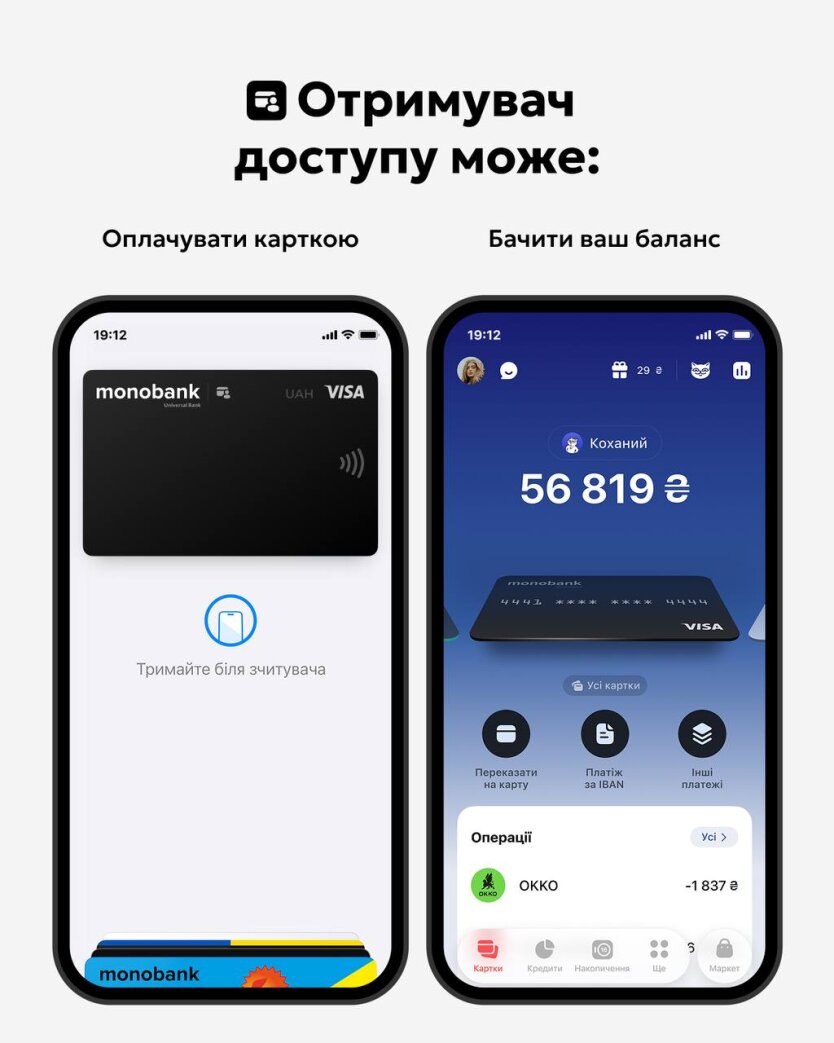

How it works

The cardholder selects the account, clicks the 'Open access' button, and adds a user, such as a partner, child, or other trusted person. After that, a monthly spending limit is set.

Features

-

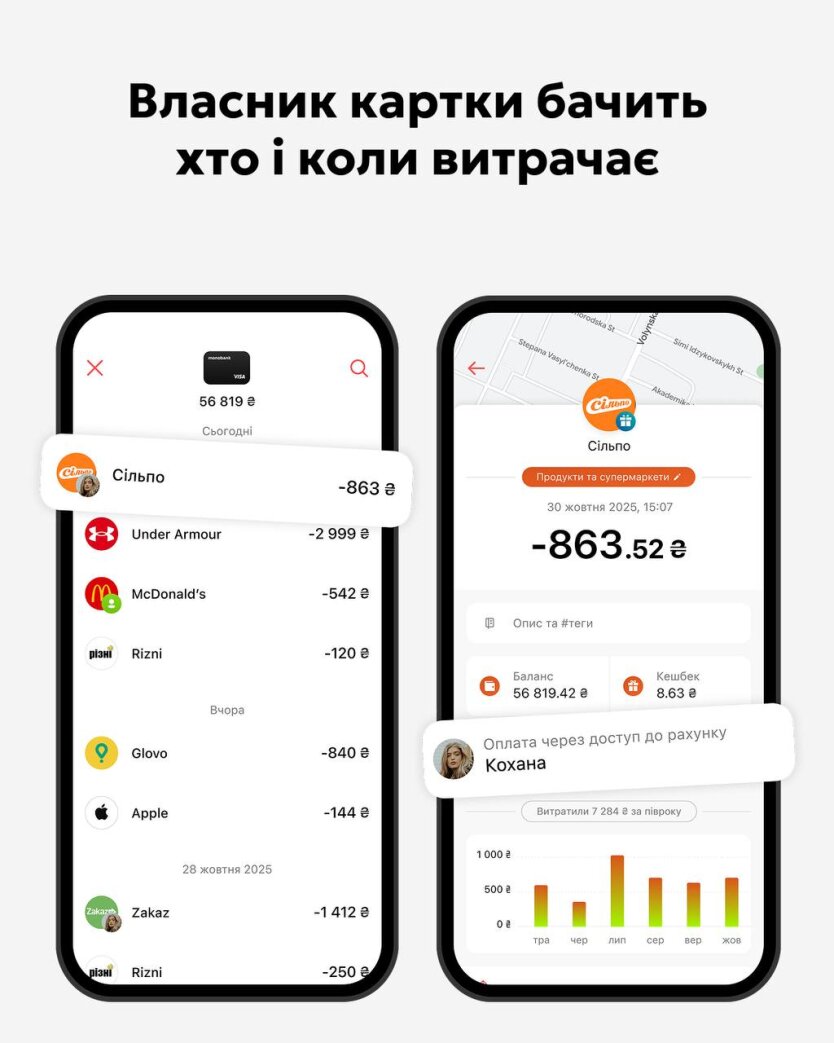

The account owner can view all transactions.

-

The user with access can see only their expenses.

Access can be revoked or closed at any moment, ensuring security from unauthorized expenses and allowing for changes in finances.

Who will be interested in this feature

-

couples sharing a budget;

-

parents who want to control their children's finances;

-

people helping elderly relatives or partners;

-

users who value transparent financial planning without stress.

This feature can become a convenient tool for joint financial management. It is important to remember to control limits and access to avoid unforeseen expenses. Also, do not forget about the 'Lemon Hunting' option in monobank.

Monobank has launched a new feature that allows sharing access to the account with spending limits. This will be a convenient tool for managing the finances of families and loved ones but requires attention to detail to avoid financial troubles.

Read also