The State Tax Service has reduced the number of business inspections by a third

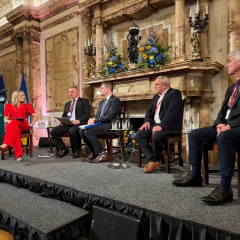

The Acting Head of the State Tax Service, Lesia Karnaukh, met with representatives of the European Business Association, which brings together more than 900 companies.

According to information from the State Tax Service, the meeting discussed issues related to the moratorium on inspections, a risk-oriented approach to tax control, and new communication formats with taxpayers.

“Our priority is to fill the state budget, and total tax control of economic entities does not bring the corresponding efficiency and increase in tax revenues. Therefore, spending the service's resources on ineffective measures is not what the tax service of 2025 is about,” Lesia Karnaukh noted.

“We are working to ensure that inspections in 2026 are planned based on developed risk passports,” Karnaukh emphasized.

Implementation of new digital tools

Participants also discussed the implementation of new digital tools. The State Tax Service is keen to engage taxpayers in testing the E-audit system. All taxpayers have been given the technical ability to test the SAF-T UA file through the “Electronic Cabinet.”

Regarding the E-excise system, the State Tax Service is already ready to implement new changes. Changes have also been made to the Cabinet of Ministers' resolution regarding the blocking of tax invoices, which will come into effect on September 27 and will allow reducing the number of economic entities facing blocking.

At the meeting of the State Tax Service representatives with the European Business Association, a number of issues related to tax control, new digital tools, and changes in the tax system were discussed. Lesia Karnaukh emphasized the importance of a risk-oriented approach and new cooperation formats with taxpayers.

Read also